- #Savings bond wizard windows 10 how to#

- #Savings bond wizard windows 10 manual#

- #Savings bond wizard windows 10 software#

- #Savings bond wizard windows 10 Pc#

Also in the account details go into Tax Schedule and set the Transfers out to: Schedule B:Int, inc, taxed only by fed.

Once created go into the account details and set it as tax deferred.

#Savings bond wizard windows 10 manual#

With the security created you need a manual entry brokerage account. Note once a bond matures, it drops off of this list. If you put in the final maturity date, there is an investment report to report these dates. To start you should create security per savings bond. For me it was a simple matter of putting in the total interest (which is redemption value minus the price paid for the bond ). I made no attempt to get an automatic transfer to a tax program right. On the subject of transferring the information to a tax program.

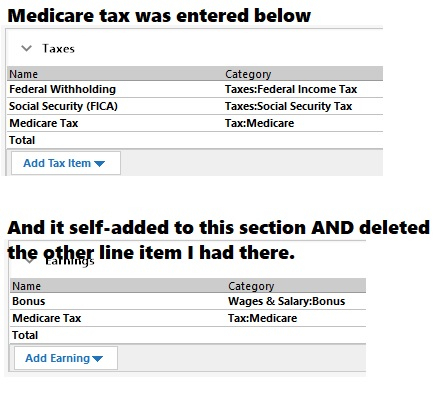

In particular I choose to pay the tax at redemption or final maturity, but I wanted to have a record of the bond going up in value so I put my bonds in an account that I market tax deferred. See the IRS publication 550 which describe your choices on paying tax and who should be paying the tax. OK first let me say that I'm not giving any tax advice and how intend to do this on the taxes might change how you would record this in Quicken. The Savings Bond Wizard will give you the Final Maturity Date, which is 30 years. Note for 'maturity' I was talking about how people tend to talk about its 'maturity date', but not talking about 'Final Maturity Date'. There is no penalty for redeeming them early. In fact the whole concept of 'maturity' is 'interesting'.Īll they have done is calculated at what date bond will earn enough interest so that its value matches its face value. Note that savings bonds do not stop earning interest at maturity. I actually used the buy bonds action, and had to compensate for the fact that bonds are 10X.įranky I could have done just as well using Buy and just setting the security to Cash in the security details.Īs for redeeming them before maturity (or after), the Savings Bond Wizard will tell exactly how much they are worth. In other words Quicken provides nothing automatic and just records a value at a given date. The very best way to keep track of value of you savings bonds is with the savings bond wizard from:Ībout all you can do with Quicken is put each bond in as a security, buy the initial amount and keep up to date by looking how much the valuehas changed in the savings bond wizard and record it as interest income. Home › Quicken for Windows › Errors and Troubleshooting (Windows)

In this program, you can buy and maintain savings bonds, Treasury bills, Treasury notes, Treasury bonds, Treasury Inflation-Protected Securities (TIPS), and Floating Rate Notes in accounts with the U.S. The most popular versions among Savings Bond Wizard users are 4.1 and 4.0.

#Savings bond wizard windows 10 software#

The software lies within Development Tools, more precisely Database Tools.

#Savings bond wizard windows 10 Pc#

This free PC program operate with the following extension: '.sbw'. The program's installer files are generally known as SBWizard.exe, IconF61E8544.exe or Wizard.exe etc.

#Savings bond wizard windows 10 how to#

No need to fire up VPC just to check on your bonds! No need to fire up VPC just to check on your bonds! Instruction video on how to use this simple savings bond calculator to compliment the one provided by the Treasury Department. Savings Bond Tracker can import CSV files created by the US Treasury Department's Windows-only Savings Bond Wizard (R). Note: Screenshots shown in the Compatibility Center are often representative of compatibility on both Mac and Linux platforms. If you would like to contribute screenshots for Savings Bond Wizard: click here.

0 kommentar(er)

0 kommentar(er)